How You Can Budget in 10 Easy Steps?

This is another time of the year, when we all have the chance to concentrate on our health, career and learning on how we can budget our finances, also to strides towards a fresh start. Among those, budgeting are still at the top of the list at the early stages.

The best thing to focus on personal finances is that a significant amount of heavy goods will be collected earlier than later in the coming months and will help the rest of the year.

The awful thing is that how did you control your personal finances in your previous year. It filled people with enthusiasm and awe.

You could scratch your head and wonder where all your money has gone. In the middle of the moment, you should remember all these are past decisions. And in the present and in the future, your personal financial habits change. Let’s start building a new budgeting for you as I discuss on this article.

• Select your budget

Your “style” based on your experience in managing your own finances, must be tailored to your specific starting point. Those who have never been very cautious with their own finances will have another budget than anyone familiar with budgeting. Their budget will be different in a few years from the previous two for those who have been working on their own budget.

And how are all these budgets different?

Never before prepared?

Your finances are a completion of their own for the first time. You might feel lost, uncertain about knowing where to get started now that you are ready to take over your finances because all of the jargon is scattered around the personal financial world.

• Tracking up your money

Make your money transparent (i.e. revenues) and money out (i.e. expenses) every month when you first see your money. Check your accounts last year and see every month how much money you’ve taken and how much money you’ve invested.

It may be terrifying for the first time ever, but bear in mind that it is only past decisions that guide current and future financial decisions.

• Financial behaviour analysis

When your revenue and expenditures have been measured for each month of the previous year, look at the general direction and examine patterns year-round.

Did you have more in or out in the particular months of the year? Remember what happened in those few months to see if your finance practices could have influenced those circumstances.

• Net Zero Monthly Target

The main objective you want to accomplish is that your finances start to budget at a net zero in revenues and expenditures every month. By that, what do I mean?

What you bring in, your profits and expenditures will be checked and we will restrict it to the end of your monthly total. If that’s bad, you’re always left to learn that you’ve spent more money than you did.

Our goal is now to prevent us from spending a month with a net monthly target of zero. It is best to know how much money you get on average or specifically every month so that you can determine how much you can spend every month.

• Any budgeting experience

We’ll be financially sound now to find ways of adjusting your budget to a number of life cycles, including shifting jobs/geographies, buying a house in the near future, and child planning.

Every day tracking of your cost of living

This down pact is probably already in effect, but it can vary from month to month but it can also change dramatically if there is a big living event on the horizon.

Now is the time to buckle and try as hard as possible by expecting high and unexpected costs as necessary for your everyday life. This gives you a greater knowledge of the everyday fluctuations, as this potential difference is baked from looking ahead.

• Save for life’s major events

I think you’re trying to take the next step in your career or personal life at this point in your life. So fantastic and exciting improvements arise on the horizon! We must begin saving our income by attending school, moving to working towns, purchasing a house, marrying, having children, etc.

Many ways to save by various forms of savings and investment plans are available – you can find choices for seeing what makes the most sense for you. Some options are open.

• Investment for the future

Now I think you have a very strong flux, often from month to month, in handling your personal finances. Two main goals of positive cash flow are your loans and your pension investment in the future.

I would spare you a debate on compound interest (this is indeed the eighth wonder of the world) and just say that while you are able to make short-term profits with your extra cash each month, it’s better to take a look at the long run when you spend the extra cash each month in an accurate and wise manner. To look at this is a wonderful reality.

• Multi-annual expertise of budgeting

Basically, when it comes to estimating your spending, looking to investments and developing new ways of growing your profits, you are a pro-nothing guy. However, there are several ways to maximize your financial condition by changing your spending.

What has taken you to your position already is continuous changes, so why not continue to improve?

• Investment limit

With various investment vehicles available, now is the time to raise your investment in order to optimize your investment from a return-to-tax point of view. You may have been exposed to various forms of investment but may not have participated in various vehicles personally. This is now the best time to explore these options.

• Costs lean

Regardless of how far you have come, you still have a way to lean your monthly expenses. Consider your day-to-day costs to see how well you match with your belief system to ensure that your hard-earned money is not wasted without end. Just one pesos wasted, you might argue, remains a dollar wasted, no matter how far financially you have come.

I hope that everyone, no matter where you are on your financial path, can find all these informative stuff useful. At the end of the day, budget preparation is a profound interpretation of your psychological and belief structures. Happy year planning and budget change!

Related article:

How to make your business to grow

Disclaimer: The details claimed in this article and the tools made available through this post shall not be interpreted or construed as financial advice. I don’t, or do not, be a lawyer, an accountant or a financial planner, and the details found in this article does not replace a professional’s financial advice who knows what and what your condition is. I am not responsible for any measures taken when you read this article. Consult a financial advisor and carry out your own due diligence before you take any action.

You May Also Like

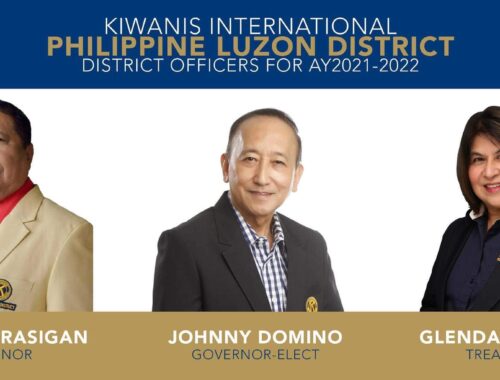

Kiwanis International Philippines’ newly elected Luzon District Officers

September 20, 2021

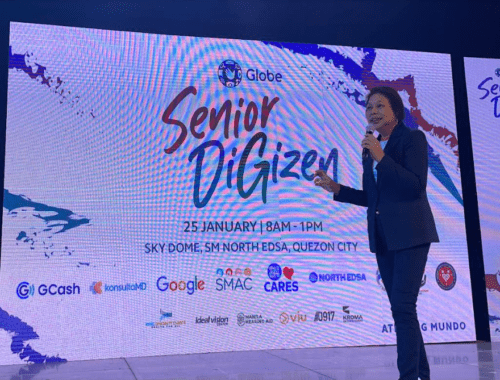

Globe Group, local partners turn Lolo, Lola into #SeniorDigizens in digital inclusion push

January 26, 2024

3 Comments

Pingback:

Pingback:

Pingback: